)

Europe and the central bank digital currencies challenge – are we still in time?

CBDCs: a global race against time, impact of blockchain on financial ecosystem and BIS's standardization efforts.

The impact of blockchain on the financial world

Since October 2020, the market has been insistently debating the Digital Euro, after the ECB published its report on the work carried out so far. This first signal, however, came after years during which the topic of digital currencies had already begun to be widely discussed in the rest of the world. So it makes sense to ask ourselves an important question: are we still in time?

Over the last decade, the financial ecosystem has suffered a strong impact caused by the advent and spread of blockchain technology and the related cryptocurrencies. The financial strategies developed by big tech companies such as Google, Amazon and Meta (Facebook) and the steady dissemination of cryptocurrencies – stablecoins in particular – have alarmed the traditional financial system, from which a response is expected.

As banks face the potential risk of disintermediation from their customers, this has progressively pushed most central banks to analyse the possibility of issuing digital currency: in other words, a Central Bank Digital Currency (CBDC).

The risk assessment and the potential impact of CBDC initiatives on the market are still open for discussion.

Global initiatives

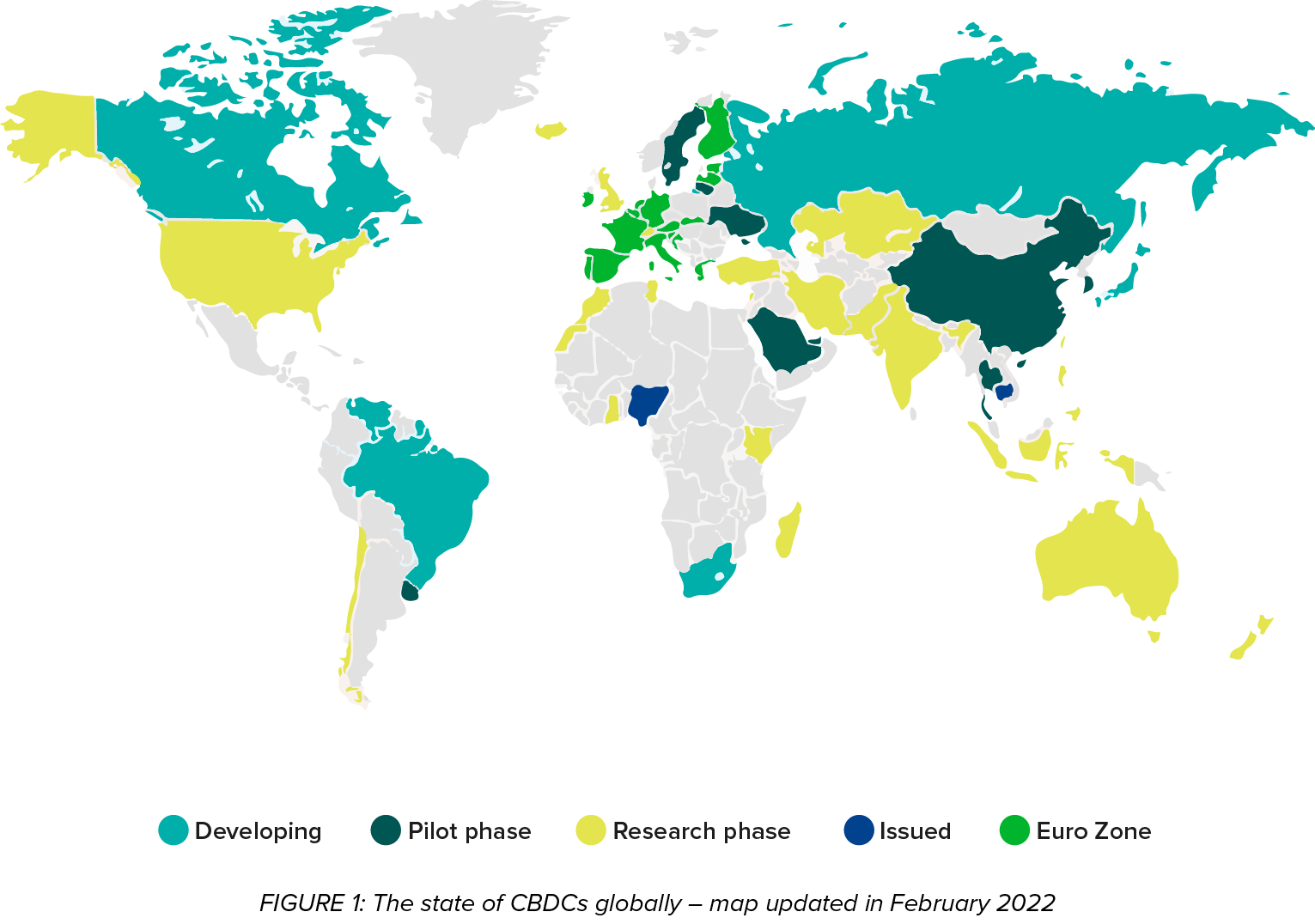

Today, there are many countries around the world interested in CBDCs: According to the latest survey conducted by the International Monetary Fund (IMF), 110 countries are working on CBDCs at various levels. The progress made in relation to the emission of a CBDC can vary greatly, as illustrated below.

Study/research phase the initial phase of analysis, preparatory to the subsequent development: this, for example, is the case for the United States, Australia and Europe itself, with the work being done by the ECB. In the United States, the Federal Reserve recently published a discussion paper examining the pros and cons of issuing a U.S. CBDC. The document summarises the current state of existing national payment systems and the new methods that have emerged in recent years, including stablecoins and other cryptocurrencies. It concludes by examining the potential benefits and risks of a CBDC, and identifies specific policies being taken into consideration. In line with the work already carried out by the EBA, this document represents the first step towards a public discussion aimed at collecting feedback from all parties involved by 20 May 2022, answering 22 questions on the potential benefits, risks and design of a CBDC. In parallel, Australia recently published a report to mark the successful conclusion of the “Atom Project”, which demonstrated the potential of a “Wholesale CBDC" in improving efficiency, risk management, and innovation in financial market transactions. More specifically, the project proposed several areas where more research and experimentation will be needed to allow the Australian government to decide whether to develop and issue its own CBDC. Finally, Meta (Facebook), which had been working for some time on its proprietary, dollar-backed stablecoin (officially renamed DIEM in 2020), found it necessary to halt the initiative due to the many difficulties encountered in the process, including strong opposition from Regulators and Central Banks and because several key partners had dropped out of the project.

Development phase: the implementation phase, in which the Central Bank develops and deploys the infrastructure that will be used for issuing and managing the digital currency: this, for example, is the case for Canada, Russia and Brazil.

Testing phase: the phase in which the virtual currency is tested in the field, in view of a subsequent launch. The most important case amongst the major world powers is China, the nation furthest along the path of adaption of its own CBDC. The Chinese testing has already involved more than 35 commercial banks, with the aim of officially launching the Digital Yuan later this year, while also taking advantage of a large event such as the 2022 Winter Olympics to carry out its pilot. In addition, in January, China released the “e-CNY” app, its wallet application available for cities where the Digital Yuan is currently in its trial phase. It enables the e-CNY system to support interoperability with traditional electronic payment systems, and to take full advantage of existing financial infrastructure, thanks to compatibility with Alipay and WeChat.

CBDC emission: the virtual currency is officially launched within the nation in which the Central Bank operates. To date, there are still very few nations that have already launched their own CBDC. In October 2020, the Central Bank of the Bahamas launched the “Sand Dollar”, thus becoming the first country in the world to officially launch a CBDC, followed by the Eastern Caribbean Central Bank, Nigeria with eNaira and Cambodia with Bakong. Specifically, this last CBDC, developed by the Japanese blockchain company Soramitsu, allows for the use of a free mobile app to make payments and transfer money through any bank on the platform, including without having a traditional current account.

The work of the BIS

The Bank for International Settlements (BIS) is carrying out a series of initiatives aimed at standardising the issuance and management of CBDCs, with a particular focus on cross-border transactions. In July 2021, in collaboration with the World Bank and the International Monetary Fund, the BIS published a report in which it signalled to the G20 the importance of using CBDCs in the international arena to improve cross-border payments and settlements.

To this end, the BIS has launched numerous projects with major central banks, such as the m-CBDC Bridge project (in collaboration with the Hong Kong Monetary Authority, the Bank of Thailand, the Digital Currency Institute of the People’s Bank of China, and the Central Bank of the United Arab Emirates) and the Dunbar project (in collaboration with the Reserve Bank of Australia, the Bank Negara Malaysia, the Monetary Authority of Singapore, and the South African Reserve Bank). These initiatives are aimed at analysing different options, in order to achieve a common goal: to demonstrate how, through the use of a CBDC, it is possible to manage the payment and settlement of cross-border transactions in real time, at a reduced cost, while eliminating inefficiencies.

In addition to the initiatives outlined above, starting this year the BIS – through its Innovation Hubs – will launch new projects focused on CBDCs, advanced payment systems, decentralised finance (DeFi), green finance, regulations and cybersecurity. Moreover, according to the latest BIS press release, CBDCs and payment system improvements continue to be an area of great interest, characterising 13 of the 17 projects already underway in 2021, or which will be launched in 2022.

Among the most relevant initiatives are those being carried out by the BRI Innovation Hub Centre in London, focused on analysing how individuals and companies can benefit from the development of CBDCs. In particular, one project aims to develop innovative payment solutions settled with the central bank currency, while the second is working on the development of a platform that supports applications which individuals and companies can use to store, transfer and pay with retail CBDCs. Finally, the projects being carried out by the BRI Innovation Hub Centre in Stockholm aim to demonstrate how payment data can be used to detect illegal activities (e.g., money laundering, tax evasion and terrorist financing), as well as to ensure the offline use of CBDCs.

Time-to-market in the CBDC race

Taking into consideration the varying levels of progress made by central banks in this area, what are the next steps on the path of CBDCs becoming a reality?

While it is true that China could launch its own digital currency as early as this year, the ECB has planned for an additional 24 months of analysis that will be followed by a development phase and a test phase: the Digital Euro will therefore not see the light of day before 2024-2025.

The real concern is China’s strategy and how it can affect the monetary policy of the rest of the world, especially if the European or US answers only come years later.

Are we still in time? Or should those who are further behind start thinking about how to tackle the growing diffusion of foreign CBDCs with solutions that have a shorter time-to-market?

Currently, the topic at the centre of discussion is the potential nationalisation of stablecoins: digital currencies backed by a fiat currency (e.g., Dollar, Euro, etc.), already widespread and present in global markets.

An obligatory consideration that would perhaps allow Europe’s supremacy and sovereignty in the management of digital currency and in the definition of monetary policies to be preserved, without entailing the transfer of economic and political sovereignty.

;Resize,width=660)

,allowExpansion;Resize,width=660)

,allowExpansion;Resize,width=660)

,allowExpansion;Resize,width=660)

,allowExpansion;Resize,width=660)

;Resize,width=660)