Financial Review

Main risks and uncertainties to which Reply S.p.A. and the Group are exposed

The Reply Group adopts specific procedures in managing risk factors that can have an influence on company results. Such procedures are a result of an enterprise management that has always aimed at maximizing value for its stakeholders putting into place all necessary measures to prevent risks related to the Group activities. Reply S.p.A., as Parent Company, is exposed to the same risks and uncertainties as those to which the Group is exposed, and which are listed below. The risk factors described in the paragraphs below must be jointly read with the other information disclosed in the Annual Report.

External risks

Risks associated with general economic conditions

The informatics consultancy market is strictly related to the economic trend of industrialized countries where the demand for highly innovative products is greater. An unfavourable economic trend at a national and/or international level or high inflation could reduce the growth of demand and consequently could have negative effects on the Group’s activities and on the Group’s economic, financial and earnings position. It should also be noted that the new scenarios of international economic policy linked to the continuation of the conflict between Ukraine and Russia and the crisis between Israel and Palestine, create uncertainties and tensions particularly within the Eurozone. Although the relative evolutions and impacts are still uncertain and difficult to assess, the intensification of ongoing geopolitical tensions and trade war could have significant negative repercussions on the global, international and Italian economy, on the performance of the financial markets and on the energy sector.

Risks related to the evolution of ict-related services

The ICT consulting services sector in which the Group operates is characterised by rapid and profound technological changes and by a constant evolution of the mix of professional skills and expertise to be pooled in the provision of the services themselves, with the need for continuous development and updating of new products and services, and a prompt go to market. Therefore, with a strong and growing focus on ethical aspects, the future development of the Group’s activities will also depend on its ability to foresee technological developments and the content of its services, also through significant investments in research and development activities, or through effective and efficient extraordinary operations.

Risks associated with competition

The ICT market is highly competitive. Competitors could expand their market share squeezing out and consequently reduce the Group’s market share. Moreover the intensification of the level of competition is also linked with possible entry of new entities endowed with human resources and financial and technological capacities in the Group’s reference sectors, offering largely competitive prices which could condition the Group’s activities and the possibility of consolidating or amplifying its own competitive position in the reference sectors, with consequent repercussions on business and on the Group’s economic, earnings and financial situation.

Risks associated with changes in client needs

The Group’s solutions are subject to rapid technological changes which, together with the growing or changing needs of customers and their own need for digitalisation, could translate into requests for the development of increasingly complex activities that sometimes require excessive commitments that are not economically proportionate, or could result in the cancellation, modification or postponement of existing contracts. This could, in some cases, have repercussions on the Group’s business and on its economic and financial situation.

Risks associated with segment regulations

The Group is subject to the laws and regulations applicable in the countries in which it operates, such as, among the main ones, regulations on the protection of occupational health and safety, the environment and the protection of intellectual property rights, tax regulations, regulations on the protection of privacy, the administrative liability of entities pursuant to Legislative Decree No. 231/01 and responsibilities under Law 262/05. The Group operates in accordance with applicable legal requirements and has established processes to ensure that it is aware of the specific local regulations in the areas in which it operates and of regulatory changes as they occur. Violations of these regulations could result in civil, tax, administrative and criminal sanctions, as well as the obligation to carry out regularisation activities, the costs and responsibilities of which could adversely affect the Group’s business and its results.

Sustainability risks

In the context of sustainability, Reply describes its material impacts, risks, and opportunities—identified through the double materiality analysis—within the chapter [SBM-3] Material impacts, risks and opportunities and their interaction with the business strategy and model of the consolidated sustainability report.

Internal risks

Risks associated with key management and loss of know-how

The Group’s success is largely due to certain key figures who have contributed in a decisive way to its development, such as the Chairman, the Chief Executive Officer and the executive directors of the Parent Company Reply S.p.A.. Reply also has a management team with many years of experience in the sector, which plays a decisive role in the management of the Group’s activities. The loss of the services of one of the aforementioned key figures without adequate replacement, as well as the inability to attract and retain new and qualified personnel, could have a negative impact on the Group’s prospects, maintenance of critical know-how, activities and economic and financial results. The Management believes, in any event, that the Company has an operational and managerial structure capable of ensuring continuity in the management of corporate affairs.

Risks associated with relationship with client

The Group offers consulting services mainly to medium and large size companies operating in different market segments (Telco, Manufacturing, Finance, etc.). A significant part of the Group’s revenues, although in a decreasing fashion in the past years, is concentrated on a relatively limited number of clients. If such clients were lost this could have an adverse effect on the Group’s activities and on the Group’s economic, financial and earnings position.

Risks associated with internationalization

The Group, with an internationalization strategy, could be exposed to typical risks deriving from the execution of its activities on an international level, such as changes in the political, macro-economic, fiscal and/or normative field, along with fluctuations in exchange rates. These could negatively influence the Group’s growth expectations abroad.

Risks related to group development

The constant growth in the size of the Group presents new management and organisational challenges. The Group constantly focuses its efforts on training employees and maintaining internal controls to prevent possible misconduct and/or ethically incorrect (such as misuse or non-compliance with laws or regulations on the protection of sensitive or confidential information and/or inappropriate use of social networking sites that could lead to breaches of confidentiality, unauthorised disclosure of confidential company information or damage to reputation). If the Group does not continue to make the appropriate changes to its operating model as needs and size change, if it does not successfully implement the changes, and if it does not continue to develop and implement the right processes and tools to manage the business and instil its culture and core values in its employees, the ability to compete successfully and achieve its business goals could be compromised.

Risks related to acquisitions and other extraordinary operations

The Group plans to continue to pursue strategic acquisitions and investments to improve and add new expertise, service offerings and solutions, and to enable expansion into certain geographic areas and other markets. Any investment made as part of strategic acquisitions and any other future investment in Italian or international companies may involve an increase in complexity in the Group’s operations and there is no guarantee that such investments will generate the expected return on the acquisition or investment decision and that they will be properly integrated in terms of quality standards, policies and procedures in a manner consistent with the rest of the Group’s operations. The integration process may require additional costs and investments. Inadequate management or supervision of the investment made may adversely affect the business, operating results and financial matters.

Risks related to non-fulfilment of contractual commitments

The Group develops high-tech, high-value solutions; the underlying contracts, which may involve both internal staff and external contractors, may provide for the application of penalties for failure to meet agreed deadlines and quality standards. The application of such penalties could have negative effects on the Group’s economic and financial results and reputation. However, the Group has taken out insurance policies, deemed adequate, to protect itself against risks arising from professional liability for an aggregate annual maximum amount deemed adequate in relation to the underlying risk. However, if the insurance coverage is inadequate and the Group is required to pay damages in excess of the maximum amount provided, the Group’s financial position, results of operations and cash flows could be materially adversely affected.

Risks related to key partnerships

In order to offer the most suitable solutions to differing customer needs, the Group has established important partnerships with leading global vendors. The business that the Group conducts through these partnerships may decline or not grow for a number of reasons, as the priorities and objectives of technology partners may differ from those of the Group and they are not prohibited from competing with the Group or entering into closer agreements with its competitors. Decisions the Group makes with respect to a technology partner may affect the ongoing relationship. In addition, technology partners may experience reduced demand for their technology or software, which could decrease the related demand for the Group’s services and solutions. The risk of failing to adequately manage and successfully develop relationships with key partners, or of failing to foresee and establish effective alliances in relation to new technologies, could adversely affect the ability to differentiate services, offer cutting-edge solutions to customers or compete effectively in the market, with possible consequent repercussions on the business and on the economic and financial situation.

Risks related to the protection of intellectual property rights

The Group’s success depends, in part, on its ability to obtain intellectual property protection for its proprietary platforms, methodologies, processes, software and other solutions. The Group relies on a combination of confidentiality, non-disclosure and other contractual agreements, and patent, trade secret, copyright and trademark laws and procedures to protect its intellectual property rights. Even where we obtain intellectual property protection, the Group’s intellectual property rights cannot prevent or discourage competitors, former employees or other third parties from reverse engineering their own solutions or proprietary methodologies and processes or independently developing similar or duplicate services or solutions. In addition, the Group may unwittingly infringe the rights of others and be liable for damages as a result. Any claims or litigation in this area could cost time and money and lead to damage the Group’s reputation and/or require it to incur additional costs to obtain the right to continue offering a service or solution to its customers. The occurrence of such risks could adversely affect the Group’s competitive advantage and market positioning, its economic, financial and capital position, as well as its reputation and prospects for future business development.

Cyber security, data management and dissemination risks

The Group’s business relies on IT networks and systems to process, transmit and store electronic information securely and to communicate with its employees, customers, technology partners and suppliers. As the scale and complexity of this infrastructure continues to grow, not least due to the increasing reliance on and use of mobile technologies, social media, cloud-based services and artificial intelligence, the risk of security incidents and cyber-attacks increases. Such breaches could result in the shutdown or disruption of the Group’s systems and those of our customers, technology partners and suppliers, and the potential unauthorised disclosure of sensitive or confidential information, including personal data. In the event of such actions, the Group could be exposed to potential liability, litigation and regulatory or other actions, as well as loss of existing or potential customers, damage to brand and reputation, and other financial losses. In addition, the costs and operational consequences of responding to violations and implementing corrective measures could be significant. To date, there hasn’t been a cybersecurity attack that has had a material effect on the Group, although there is no guarantee that there won’t be a material impact in the future. Aware that the business and cyber security landscape evolves, the Group is continuing on a path of unceasing strengthening of risk controls, reserving the right, if deemed necessary, to make significant additional investments to protect data and infrastructure. However, if the insurance coverage, which includes IT insurance, is inadequate and the Group is required to pay damages in excess of the maximum amount provided, the Group’s financial position, results of operations and cash flows could be materially adversely affected.

Risks in terms of social and environmental responsibility and business ethics

In the context of social, environmental, and business ethics responsibility, Reply describes its material impacts, risks, and opportunities—identified through the double materiality analysis—within the chapter [SBM-3] Material impacts, risks and opportunities and their interaction with the business strategy and model of the consolidated sustainability report.

Financial risks

Credit risk

For business purposes, specific policies are adopted to assure its clients’ solvency. With regards to financial counterparty risk, the Group does not present significant risk in credit-worthiness or solvency.

The Group’s exposure to credit risk is the potential losses that could result from non-fulfilment of the obligations assumed by both commercial and financial counterparties. In order to measure this risk over time, as part of the impairment of its financial assets (including trade receivables), the Group has applied a model based on expected credit losses pursuant to IFRS 9. This exposure is mainly due to general economic and financial items, the possibility of specific insolvency situations of some debtor counterparties and more strictly technical-commercial or administrative elements. The maximum theoretical exposure to credit risk for the Group is the book value of financial assets and trade receivables. The risk related to trade receivables is managed through the application of specific policies aimed to ensure the solvency of customers. Provisions to the allowance for doubtful accounts are made specifically on creditor positions with specific risk elements. On creditor positions which do not have such characteristics, provisions are made on the basis of the average default estimated on the basis of statistical indicators.

Liquidity risk

The group is exposed to funding risk if there is difficulty in obtaining finance for operations at any given point in time. The cash flows, funding requirements and liquidity of the Group’s companies are monitored or centrally managed under the control of the Group Treasury, with the objective of guaranteeing effective and efficient management of capital resources (maintaining an adequate level of liquid assets and funds obtainable via an appropriate committed credit line amount). The difficult economic and financial context of the markets requires specific attention as regards the management of liquidity risk and in such a way that particular attention is given to shares tending to generate financial resources with operational management and to maintaining an adequate level of liquid assets. The Group therefore plans to meet its requirements to settle financial liabilities as they fall due and to cover expected capital expenditures by using cash flows from operations and available liquidity, renewing or refinancing bank loans.

Exchange rate and interest rate risk

The Group entered into most of its financial instruments in Euros, which is its functional and presentation currency. Although it operates in an international environment, it has a limited exposure to fluctuations in the exchange rates. The exposure to interest rate risk arises from the need to fund operating activities and M&A investments, as well as the necessity to deploy available liquidity. Changes in market interest rates may have the effect of either increasing or decreasing the Group’s net profit/(loss), thereby indirectly affecting the costs and returns of financing and investing transactions. The interest rate risk to which the Group is exposed mainly derives from bank loans; to mitigate such risks, the Group, when necessary, has used derivative financial instruments designated as “cash flow hedges”. The use of such instruments is disciplined by written procedures in line with the Group’s risk management strategies that do not contemplate derivative financial instruments for trading purposes.

Tax risk

The risk of any changes in tax law and its application or interpretation could have a negative or positive impact on the Group’s results of operations, affecting the effective tax rate. The Company adheres to the National Tax Consolidation scheme pursuant to articles 117/129 of the Consolidated Income Tax Act (TUIR). Reply S.p.A., the Parent Company, acts as consolidating company and determines a single taxable income for the Group of companies participating in the Tax Consolidation, benefiting from the possibility of offsetting taxable income with tax losses in a single declaration. The tax risk limitation measures put in place by Management, in terms of verifying the adequacy and correctness of tax compliance, obviously cannot completely exclude the risk of tax audits.

Review of the Group’s economic and financial position

Foreword

The financial statements commented on and illustrated in the following pages have been prepared on the basis of the Consolidated financial statements as at 31 December 2024 to which reference should be made, prepared in compliance with the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) and adopted by the European Union, as well as with the provisions implementing Article 9 of Legislative Decree No. 38/2005.

Trend of the period

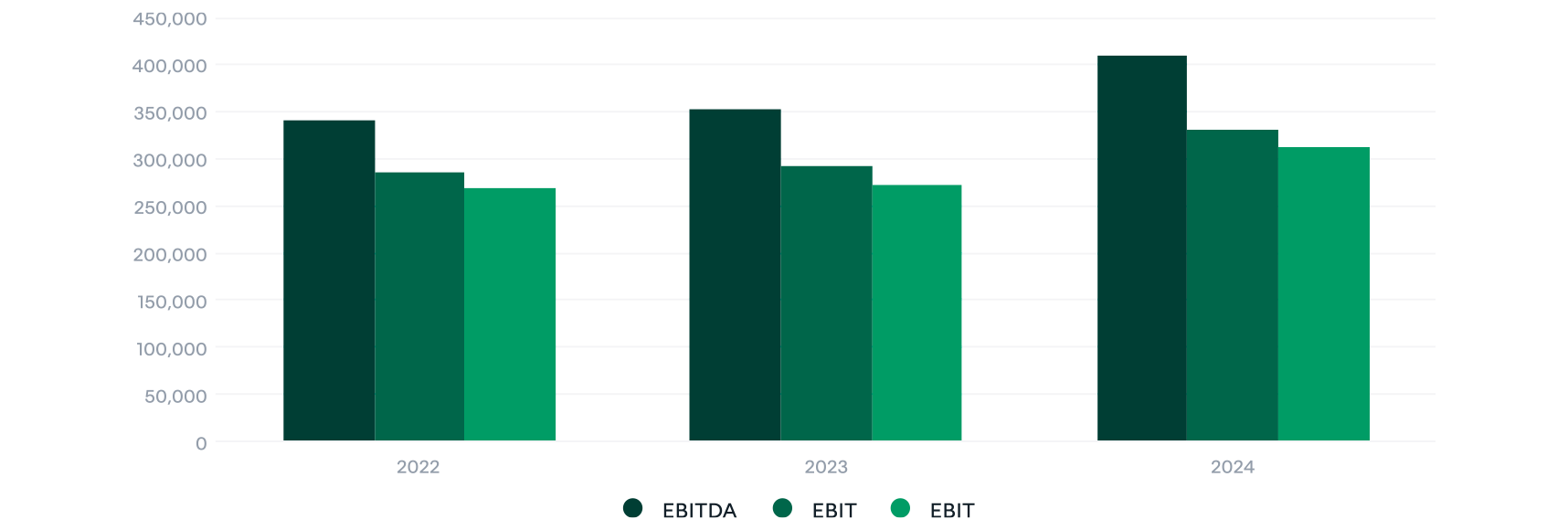

The Reply Group closed 2024 with a consolidated turnover of €2,295.9 million an increase of 8.4% compared to €2,118.0 million in 2023. All indicators are positive for the period. Consolidated EBITDA was €410.6 million, an increase of 16.6% compared to €352.1 million at December 2023. EBIT, from January to December, was at €330.4 million, which is an increase of 12.9% compared to €292.7 million at December 2023. The Group net profit was at €211.1 million. In 2023, the corresponding value was €186.7 million. Following the results achieved in 2024, the Reply Board of Directors decided to propose a dividend distribution of €1.15 per share to the next Shareholders’ Meeting, which will be payable on 21 May 2025, with the dividend date set on 19 May 2025 (record date 20 May 2025). As at 31 December 2024, the Group’s net financial position was positive at €349.1 million (204.9 million at 31 December 2023). As at 30 September 2024, the net financial position was positive at €312.6 million.

2024 closed with very positive results for Reply, confirming once again Reply’s ability to interpret market needs and develop cutting-edge digital solutions in an increasingly dynamic and complex global context. In a macroeconomic scenario characterised by uncertainties and deep transformations, Reply has continued to grow, supported by the solidity of its model based on a network of highly specialised companies.

This positioning, has allowed Reply to be among the first on the market to offer innovative, integrated and competitive solutions able to make the most of the ever-increasing spread of artificial intelligence within corporate systems, strengthening its leadership position in the fields of digital creativity, system integration and consulting.

In the last twelve months artificial intelligence has crossed the threshold of innovation to become an essential pillar of industrial and social transformation. Reply’s clients are asking for applications that no longer merely improve existing processes, but support the introduction of new operational methods, new business models, and enable the development of entire categories of products and services that were previously unthinkable.

Reclassified consolidated income statement

Reply’s performance is shown in the following reclassified consolidated statement of income and is compared to corresponding figures of the previous year:

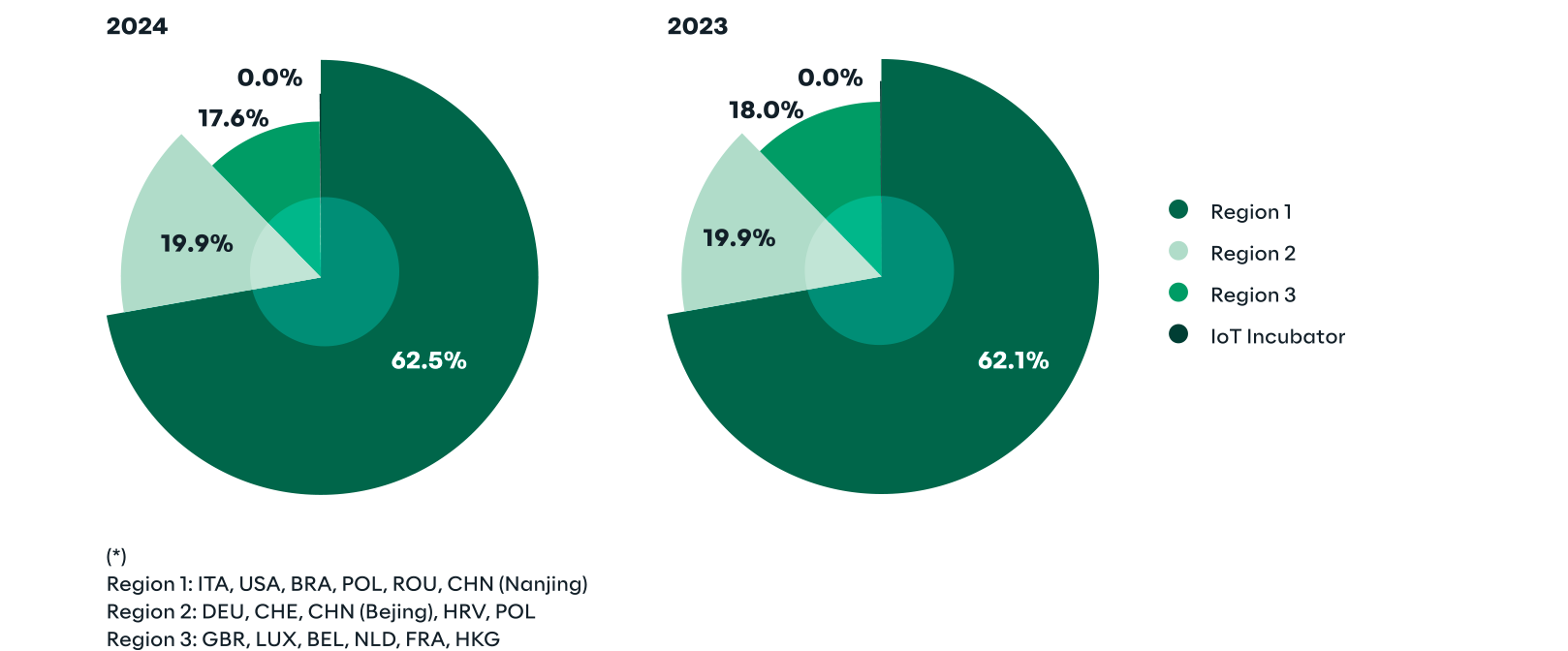

REVENUES BY REGION (*)

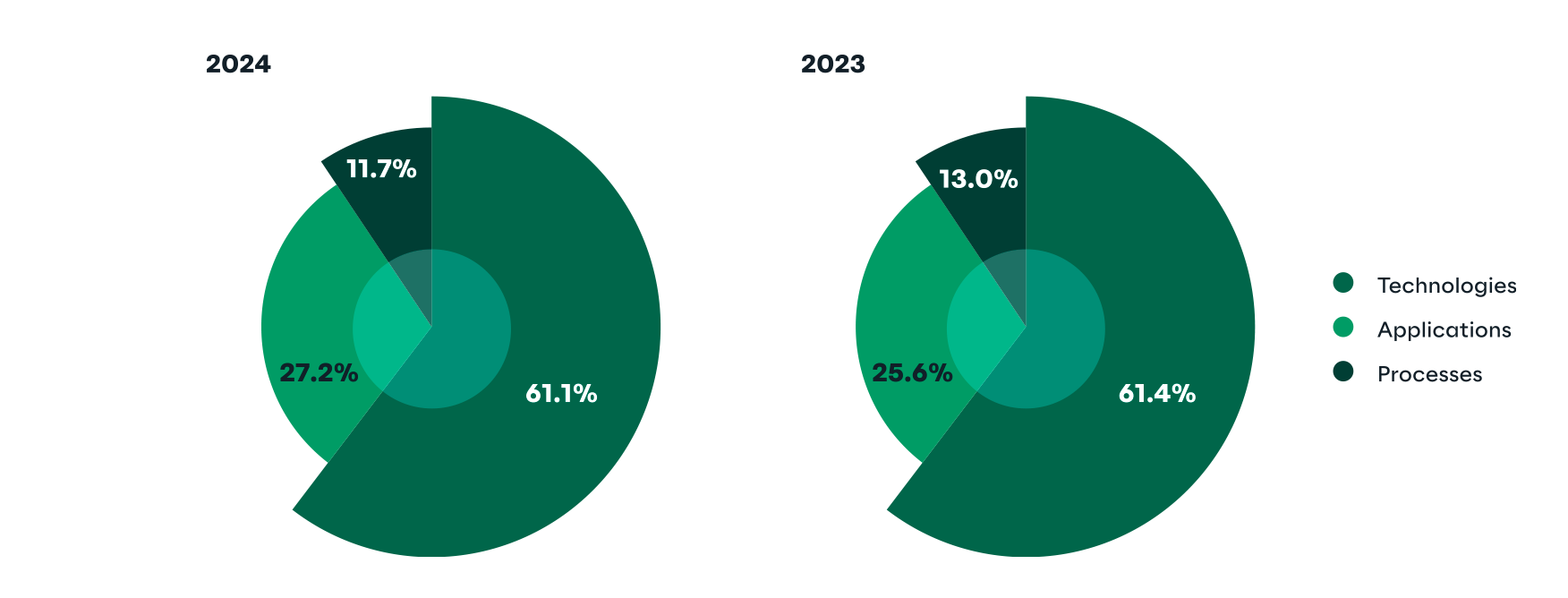

REVENUES BY BUSINESS LINES

TREND IN KEY ECONOMIC INDICATORS

Analysis of the financial structure

The Group’s financial structure as at 31 December 2024 is set forth below, compared to 31 December 2023:

Net invested capital on 31 December 2024, amounting to 953,876 thousand Euros, was funded by Shareholders’ equity for 1,302,960 thousand Euros and by available overall funds of 349,084 thousand Euros.

It is to be noted that net invested capital includes Due to minority shareholders and Earn-out for a total of 109,600 thousand Euros (114,368 thousand Euros at 31 December 2023); this item is not included in the net financial managerial position included instead in the ESMA net financial indebtedness, disclosed in note 30.

The following table provides a breakdown of net working capital:

With reference to working capital related to business operations, which would therefore include only trade receivables, work in progress and trade payables, return on revenue would be equal to approximately 13.7% compared to 14.1% of the previous year.

Net managerial financial position and cash flows statement

Change in the item cash and cash equivalents during 2024 is summarized in the table below:

The complete consolidated cash flow statement and the details of cash and other cash equivalents net are set forth below in the financial statements.

Alternative performance indicators

In addition to conventional financial indicators required by IFRS, presented herein are some alternative performance measures, in order to allow a better understanding of the trend of economic and financial management.

These indicators, that are also presented in the periodical Interim management reports must not, however, be considered as replacements to the conventional indicators required by IFRS.

Set forth below are the alternative performance indicators used by the Group with relevant definition and basis of calculation:

EBIT: corresponds to the “Operating margin”

EBITDA: Earnings before interest, taxes, depreciation and amortization and is calculated by adding to the Operating margin the following captions:

Amortization and depreciation

Write-downs

Other unusual costs/(income)

EBT: corresponds to the Income before taxes

Net financial managerial position: represents the financial structure indicator and is calculated by adding the following balance sheet captions:

Cash and cash equivalents

Financial assets (short-term)

Financial liabilities (long-term) including those referable to the adoption of IFRS 16

Financial liabilities (short-term) including those referable to the adoption of IFRS 16

Other non-recurring (costs)/revenues are related to events and transactions that due to their nature do not occur continuously in normal operations.

Significant operations in 2024

Acquisition of Solirius Ltd

In October 2024 Reply Ltd acquired 100% of the share capital of Solirius Ltd., a UK company leader in digital transformation for the public sector.

Established in 2007 in London, Solirius offers consultancy services that focus on redefining work practices and business processes to become more customer-centric and sustainable, combining expertise that ranges from data architecture design to the development and implementation of new digital services.

With a strong focus on software development, agile delivery, artificial intelligence and data management, Solirius works with leading UK government agencies in the process of digital transformation and the adoption of new technologies to support citizen services. Among Solirius’ clients are HMCTS (HM Courts & Tribunals Service), FCDOS (Foreign, Commonwealth & Development Office Services), DfE (Department for Education), and BDUK (Building Digital UK).

The investment in Solirius is part of Reply’s international growth strategy, particularly in the UK, where Reply, with offices in London and Manchester, counts most of the leading groups in the retail, financial services, and transportation sectors among its clients.

Reply on the stock market

Reply share performance

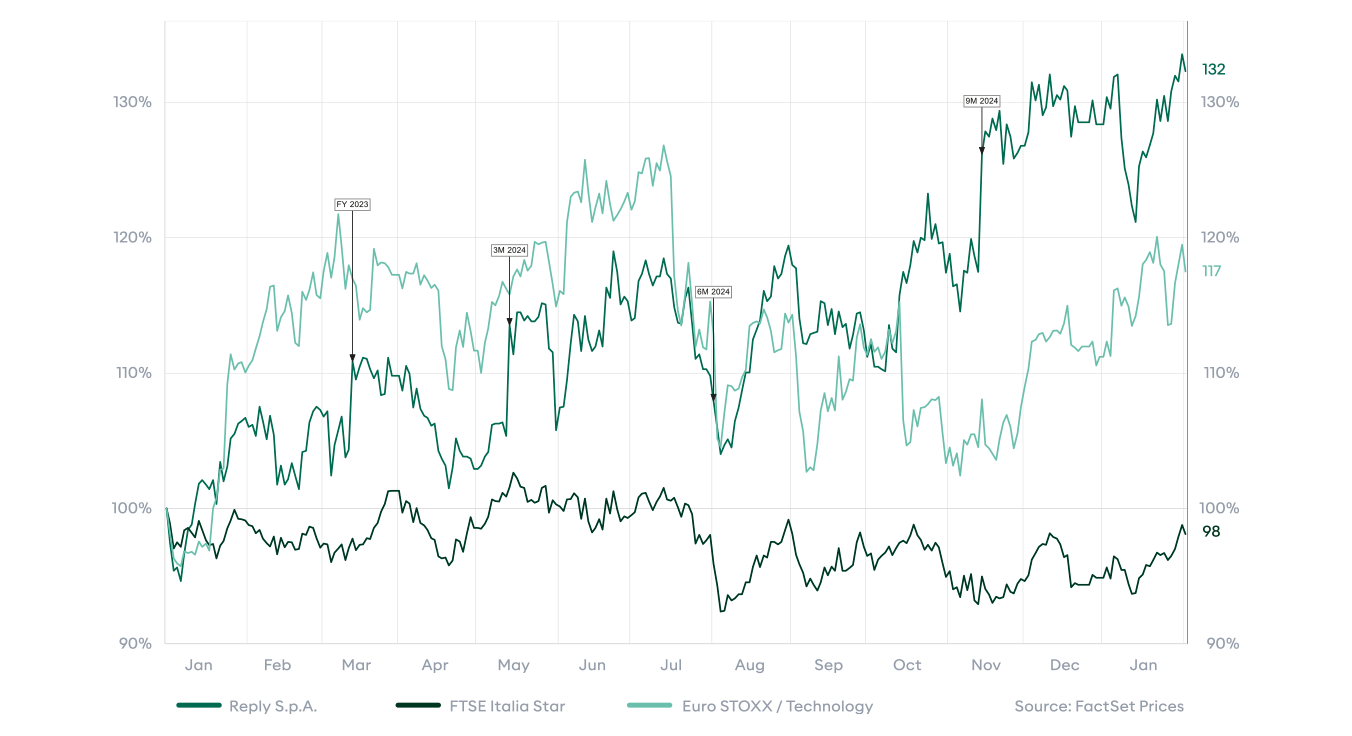

After a volatile year on the stock markets in 2023, the capital markets also had to overcome a number of challenges in 2024. However, although geopolitical tensions, wars, natural disasters and increasing political polarisation dominated the news, the capital markets were little impressed. The cause of these developments was the almost ideal mix of falling interest rates and the prospect of further interest rate cuts, rising GDP figures and corporate profits, as well as deregulation and tax cuts in the US. In a first step, central banks worldwide, and particularly in the US and Europe, began to cut interest rates in line with falling inflation. Liquidity and favourable refinancing costs for private individuals and companies are key drivers of a positive stock market performance. Furthermore, corporate earnings have risen for the major companies that are relevant to the stock markets, despite recessionary trends in Europe. This is particularly true in the tech sector in connection with the boom in artificial intelligence, but also in many other areas, such as the banking sector or the defence sector. Although there were occasional corrections on the stock markets over the course of the year, the old highs were often reached again or even exceeded as a result. As a result, several stock indices reached record levels in 2024. In a long-term comparison since the turn of the millennium, the 2024 stock market year is in the top third. Similar to the turn of the millennium, the stock market year 2024 also rewarded those who bet everything on tech stocks. Once again, stocks with a high correlation to the hot topic of artificial intelligence were the main drivers. Artificial intelligence remains the dominant topic in the technology sector. While in 2023 it was mainly manufacturers of AI chips such as NVIDIA and Broadcom that benefited from developments, large cloud providers such as AWS (Amazon), Microsoft and Google Cloud are now investing billions in the expansion of high-speed data centres. AI is also a top priority for corporate customers in their IT budgets, and the investment surge is likely to increase significantly by 2025. So far, AI is not widely used and only a fraction of its possible applications have been developed. However, progress in AI shows that these models could develop faster than expected and that AI could therefore enter the utilisation phase earlier. All this suggests that the AI narrative and market reactions are likely to remain dynamic in the future. Even with more efficient AI models, high levels of spending may still be needed to drive further innovation, such as general artificial intelligence.

The financial year 2024 started well for Reply with the share price steadily closing the gap to the performance of the EuroSTOXX Technology and since mid of July 2024 faring better than this index. One of the main reasons for this was Reply’s continuous outperformance compared to most of its competitors in terms of revenue growth and margin development. Since October 2024 the share entered an upward corridor, with the share price rising to its 2024 maximum of EUR 157.80 on 17 December 2024 and closing the year at EUR 153.40. Reply’s market capitalisation increased to EUR 5.7 billion. In January 2025, the upward development of the Reply share continued. At the time of writing this chapter, the Reply share was trading at EUR 159.60, with a market capitalisation of EUR 5.9 billion. In 2024, Reply’s performance was clearly better than the various country and sector indices and most of the peer group companies. More and more investors perceived the impact of artificial intelligence is as well positive for IT services companies and not only for hardware and software vendors. In parallel the hopes of many players in the market for an improving business in the 2nd half of 2024 not materialized, leading to several business plan revisions. Accordingly, the Tech indices like the EuroSTOXX Technology (+11%) and S&P 500/IT (36%) indices developed less strong than the year before.

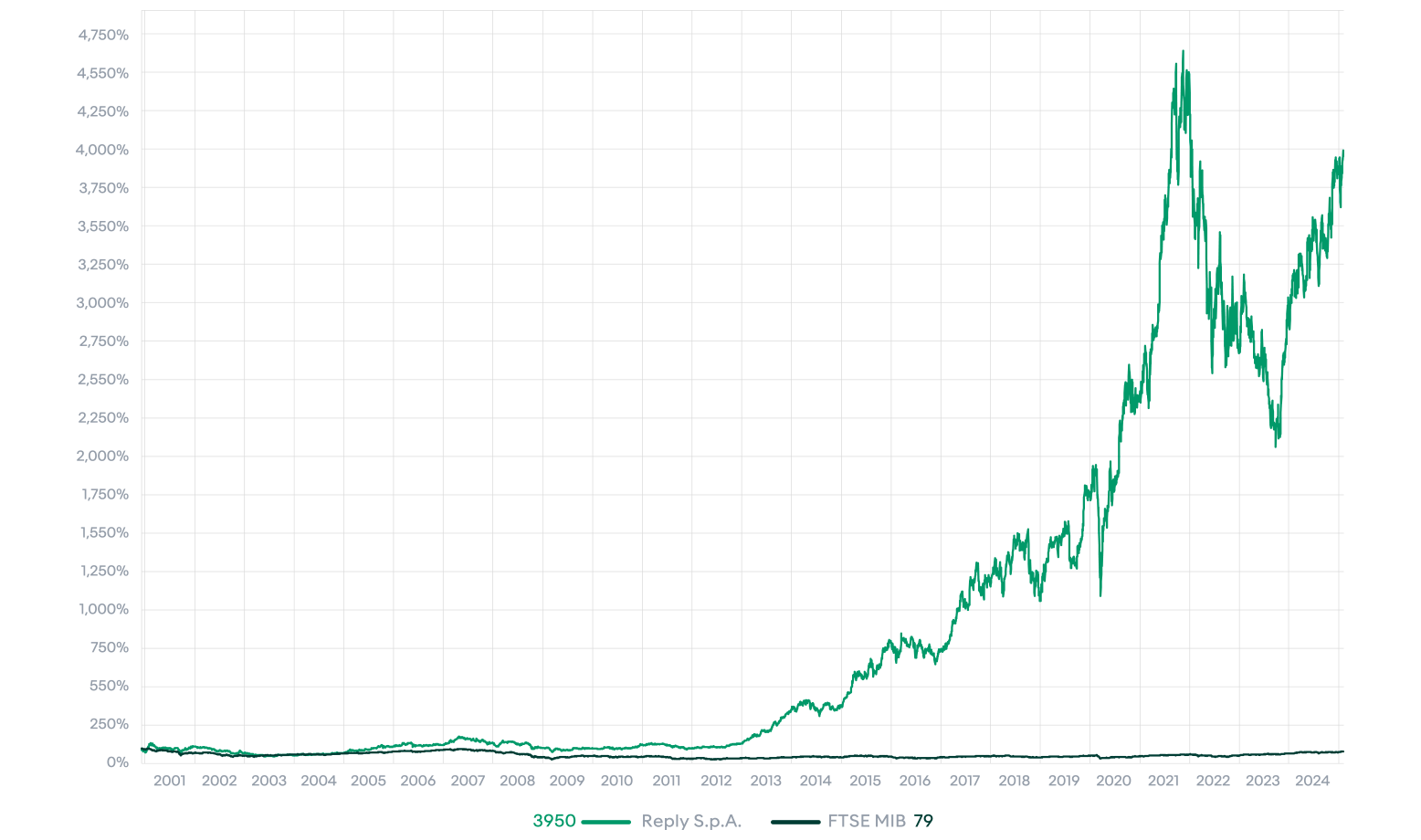

Taking December 6, 2000, the date of the Reply IPO, as a reference, the Italian main index MIB gained 12.6% in 2024 and stood at 74.8% of its starting value. In the same period Reply increased its IPO value by 3,735%. The outperformance of the Reply share versus the MIB increased significantly in 2024 and amounted to 3,760%.

Share liquidity

2024 showed that Artificial Intelligence is not a threat, but a big opportunity - also for IT Services companies, and not only for the hardware and software vendors. The reduced uncertainty and volatility led to a significant reduction of the trading activities in the Reply share. The number of traded shares reduced by 23% to 9.5 million shares (12.7 million shares in 2023). On the other hand, the trading volume remained stable amounting unchanged to EUR 1.32 billion. The strong increase of the share price compensated the reduction in the number of shares traded. The improvement of the Reply share price - especially the strong performance of the 4th quarter where nearly 50% of the increase took place, had a substantial impact on the valuation multiples seen in Reply. While most of the Reply peers - defined as a group of digital native companies, diversified IT Service companies and agencies - declined in valuations, Reply belonged to the few companies who were able to raise their valuations. Reply is now trading between 33% (Enterprise Value/EBITDA) and 57% (Price/Earnings Ratio) above the peer valuations.

Dividend

Performance-related remuneration is an essential pillar of Reply’s partnership-based business model. Like employees, Reply’s shareholders should participate in the Group’s sustainable operational performance in the form of dividends. Every year this principle is balanced with the need for internal financing to finance Reply’s investments (in new start-up companies, new technologies and potential acquisitions to further elaborate Reply’s offering portfolio in Germany, UK, US, France as Reply’s strategic regions). In 2024 Reply achieved earnings per share of EUR 5.65, an increase of 13% compared to 2023. For the financial year 2024 the corporate bodies of Reply propose to the shareholders’ meeting to approve the payment of a dividend of EUR 1.15 (dividend 2023: EUR 1.00). Referred to the share price of Reply at the end of 2024 this corresponds to a dividend yield of 0.75%. Assuming the approval of the shareholders’ meeting, Reply will pay to its share-holders a dividend amount of EUR 43.0 million. For financial year 2023 EUR 37.3 million were distributed. In total this equates to a pay-out ratio of 20% of the net profit of the financial year 2024.

The subsequent table gives an overview on the main parameters of the Reply share and their substantial developments during the last 5 years.

The shareholders base

At the end of 2024, 41.9% of Reply’s shares were owned by Reply’s founders. Institutional shareholders owned 48% of the shares, while retail shareholders owned 9.8% of the shares. Reply’s institutional share-holder base has undergone some significant changes. US investors, the main investor country in Reply, showed a quite stable ownership in Reply, their share rose to 27% of the institutional shareholding com-pared to 26% in the previous year. Italian investors continued to increase their positions and are now the second largest investors, holding approximately 24% (same as 2022: 22%). UK investors increased their position to 12% of institutional holdings. French investors were stable at 10% of the shares. According to the Shareholders’ Ledger, on the date of this report the shareholders that directly or indirectly, also through an intermediary person, trust companies and subsidiaries, hold stakes greater than 3% of the share capital having the right to vote are the following:

As of December 31, 2024, Mr. Mario Rizzante controls 100% of the company Iceberg S.r.l., a limited liability company based in C.so Francia 110, Turin. Iceberg S.r.l. controls 51% of the company Alika S.r.l., which in turn directly holds, as of today, 13,872,740 shares of Reply S.p.A. (with increased voting rights as of 21 February 2020) equal to 37.082% of the Company’s share capital.

Analysts

In 2024, the number of analysts regularly covering the Reply share rose by 25%. Reply welcomed 2 new UK analysts among its group of analysts. Despite of the strong development of the Reply share, the analyst mood improved slightly. In 2024 4 ratings out of 10 ratings were on “outperform”. In the year before 5 analysts of out 8 ratings took a “neutral” stance on the share. The average price target for Reply shares by analysts in January 2025 was 152.6 euros.

Dialog with the capital markets

An active and open communication policy, which ensures the timely and continuous dissemination of information, is an essential part of Reply’s IR strategy. In 2024 Reply further increased its already high level of activity with the capital markets significantly. During 18 conferences and 13 road shows, Reply actively explained its equity story. The number of virtual meetings with investors remained stable. In parallel Reply increased the number of physical investor meetings by 22%. In 2024 Reply also added earnings calls to its communication strategy. Since the H1 2024 results the CEO and the CFO of Reply are on a quarterly base commenting the operational and financial performance of Reply. The majority of communication contacts were with French, Italian and UK investors. The highest increases were seen with US and UK investors where the contacts grew more than 40% in 2024. Also, French and Italian investors increased their contacts with Reply at a double-digit rate. The number of brokers involved in Reply’s IR activities fell from 13 to 12.

The parent Company Reply S.p.A.

Introduction

The tables presented and disclosed below were prepared on the basis of the financial statements as at 31 December 2024 to which reference should be made, and prepared in accordance with the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) and endorsed by the European Union, as well as with the regulations implementing Article 9 of Legislative Decree No. 38/2005.

Reclassified income statement

The Parent Company Reply S.p.A. mainly carries out the operational co-ordination and the technical and quality management services for the Group companies as well as the administration, finance and marketing activities. As at 31 December 2024 the Parent Company had 264 employees (108 employees in 2023). Reply S.p.A. also carries out commercial fronting activities (pass-through revenues) for some major customers, whereas delivery is carried out by the operational companies. The economic results achieved by the Company are therefore not representative of the Group’s overall economic trend and the performances of the markets in which it operates. Such activity is instead reflected in the item Pass-through revenues of the Income Statement set forth below.

The Parent Company’s income statement is summarized as follows:

Revenues from operating activities mainly refer to:

royalties on the Reply trademark for 62,394 thousand Euros (58,424 thousand Euros in the financial year 2023);

shared service activities in favour of its subsidiaries for 63,590 thousand Euros (60,154 thousand Euros in the financial year 2023);

management services for 31,907 thousand Euros (15,634 thousand Euros in the financial year 2023).

Operating income 2024 marked a negative result of 6,823 thousand Euros after having deducted amortization expenses of 4,188 thousand Euros (of which 371 thousand Euros referred to tangible assets, 2,560 thousand Euros to intangible assets and 1,256 thousand Euros related to RoU assets arising from the adoption of IFRS 16). Financial income amounted to 41,925 thousand Euros and included interest income on bank accounts for 39,919 thousand Euros, interest expenses for 16,695 thousand Euros mainly relating to financing for the M&A operations and interest expenses on bank accounts. Such result also includes net positive exchange rate differences amounting to 16,494 thousand Euros. Income from equity investments which amounted to 50,058 thousand Euros refers to dividends received from subsidiary companies in 2024. Losses on equity investments referred to write-downs and losses reported in the year by some subsidiary companies that were considered to be unrecoverable. Net income for the year ended 2024, amounted to 50,644 thousand Euros after income taxes of 10,216 thousand Euros.

Financial structure

Reply S.p.A.’s financial structure as at 31 December 2024, compared to 31 December 2023, is provided below:

The net invested capital on 31 December 2024, amounting to 269,936 thousand Euros, was funded by Shareholders’ equity for 743,596 thousand Euros and by available overall funds of 473,659 thousand Euros. Changes in balance sheet items are fully analysed and detailed in the explanatory notes to the financial statements.

Net financial managerial position

The Parent Company’s net financial managerial position as at 31 December 2024, compared to 31 December 2023, is detailed as follows:

Change in the net financial managerial position is analysed and illustrated in the explanatory notes to the financial position.

Reconciliation of equity and profit for the year of the parent company

In accordance with Consob Communication no. DEM/6064293 dated 28 July 2006, Shareholders’ equity and the Parent Company’s result are reconciled below with the related consolidated amounts.

Corporate Governance

The Corporate Governance system adopted by Reply - issuer listed at Euronext Star Milan - adheres to the Corporate Governance Code for Italian Listed Companies issued by Borsa Italiana S.p.A..

In compliance with regulatory obligations the annually drafted “Report on Corporate Governance and Ownership Structures” contains a general description of the corporate governance system adopted by the Group, reporting information on ownership structures and compliance with the Code, including the main governance practices applied and the characteristics of the risk management and internal control system also with respect to the financial reporting process. The aforementioned Report, related to 2024, is available on the website www.reply.com. The Corporate Governance Code is available on the website of Borsa Italiana S.p.A. https://www.borsaitaliana.it/comitato-corporate-governance/codice/2020.pdf.

Other information

Research and development activities

Reply offers high technology services and solutions in a market where innovation is of primary importance.

Reply considers research and continuous innovation a fundamental asset in supporting clients with the adoption of new technology. Reply dedicates resources to Research and Development activities in order to project and define highly innovative products and services as well as possible applications of evolving technologies. In this context, Reply has developed of its own platforms. Reply has important partnerships with major global vendors so as to offer the most suitable solutions to different company needs. Specifically, Reply boasts the highest level of certification amongst the technology leaders in the Enterprise sector.

Human resources

Human resources constitute a primary asset for Reply which bases its strategy on the quality of products and services and places continuous attention on the growth of personnel and in-depth examination of professional necessities with consequent definitions of needs and training courses. The Reply Group is comprised of professionals originating from the best universities and polytechnics. The Group intends to continue investing in human resources by bonding special relations and collaboration with major universities with the scope of attracting highly qualified personnel. The people who work at Reply are characterized by enthusiasm, expertise, methodology, team spirit, initiative, the capability of understanding the context they work in and of clearly communicating the solutions proposed. The capability of imagining, experimenting and studying new solutions enables more rapid and efficient innovation. The group intends to maintain these distinctive features by increasing investments in training and collaboration with universities. At the end of 2024 the Group had 15,667 employees compared to 14,798 in 2023.

General Data Protection Regulation (GDPR)

The governance model of the Group privacy policy reflects what is required by the existing code for the protection of personal data and the European Regulation 679/16 (GDPR). Privacy fulfilments are managed uniformly at the Reply Group level in order to maintain adequate levels of internal coherence and to facilitate external relations, in particular with authorities, customers and suppliers. To ensure compliance the Group has adopted a GDPR program which provides several activities including:

updating the Group privacy organizational model;

designation for each Region of a Data Protection Officer;

reorganization of the central Privacy & Security Team;

preparation of contact link with the DPO and the Privacy & Security Team through a central ticketing system;

updating of e-learning and induction material related to data protection content and safeguard of information;

mandatory GDPR and ICT Security training at all business levels;

assessment of privacy and security of IT central services;

drafting of Records of the treatment activities;

development and dissemination of new fundamental processes for GDPR, updating of existing data protection policies, development and dissemination of guidelines and contractual templates for GDPR;

periodic internal audits on the Companies for the correct application of the GDPR requirements in the work for Customers and in the engagements of Suppliers.

Transactions with related parties and group companies

During the period, there were no transactions with related parties, including intergroup transactions, which qualified as unusual or atypical. Any related party transactions formed part of the normal business activities of companies in the Group. Such transactions are concluded at standard market terms for the nature of goods and/or services offered, these transactions took place in accordance with the internal procedures containing the rules aimed at ensuring transparency and fairness, under Consob Regulation 17221/2010. The company in the notes to the financial statements and consolidated financial statements provides the information required pursuant to Art. 154-ter of the TUF [Consolidated Financial Act] as indicated by Consob Reg. no. 17221 of 12 March 2010 and subsequent Consob Resolution no. 17389 of June 23, 2010, indicating that there were no significant transactions concluded during the period as defined by Art. 4, paragraph 1, let a) of the aforementioned regulation that have significantly affected the Group’s financial or economic position. The information pursuant to Consob communication of 28 July 2006 are presented in the annexed tables herein.

Treasury shares

At the balance sheet date, the Parent Company holds 133,192 treasury shares amounting to 17,122,489 Euros, nominal value equal to 17,315 Euros; at the balance sheet item net equity, the company has posted an unavailable reserve for the same amount. At the balance sheet date, the Company does not hold shares of other holding companies.

Financial instruments

In relation to the use of financial instruments, the company has adopted a policy for risk management through the use of financial derivatives, with the scope of reducing the exposure to interest rate risks on financial loans. Such financial instruments are considered as hedging instruments as they can be traced to the object being hedged (in terms of amount and expiry date).

In the notes to the financial statements more detail is provided to the above operations.

Secondary Offices

The Group operates in 16 countries through a total of 57 offices, ensuring a strategic presence in the main reference markets. The geographical distribution of the locations reflects the Group’s commitment to offering efficient services tailored to local needs.

Pillar 2

In December 2021, the Organisation for Economic Co-operation and Development (OECD) published the document “Tax Challenges Arising from the Digitalisation of the Economy - Administrative Guidance on the Global Anti-Base Erosion Model Rules (Pillar Two)”.

In this context, the European Commission has adopted EU Directive no. 2022/2523 on global minimum taxation for multinational groups of companies, with an obligation for Member States to transpose EU provisions into their national law by 31 December 2023 and to apply them from tax periods starting from that date.

The Pillar Two rules aim to ensure, through a system of common rules, a minimum level of effective taxation of not less than 15% in each jurisdiction in which a multinational group operates.

In transposition of Directive no. 2022/2523, Italy issued Legislative Decree 209/2023, which were followed by subsequent implementing decrees. The national provisions apply with reference to tax periods starting from 31 December 2023 and, therefore, for Reply from 2024.

In order to regulate, in terms of financial statements, the radical changes deriving from the introduction of the Global Minimum Tax, the IASB subsequently published an update of IAS 12. In particular, the amendments made to the accounting standard introduce a mandatory temporary exception that provides for the deferred taxation that would result from the implementation of Pillar Two in the relevant countries not to be recognised. This exception, which the Group also uses for the purposes of this policy, is immediately applicable and with retroactive effect.

In the face of these complex regulatory changes, the Group (which falls within the subjective scope of application of the GMT) is currently engaged in the implementation of the internal procedures necessary to manage the obligations imposed by the Pillar Two regulations in the most effective and efficient way, with reference to both Italian and foreign activities. In this context, careful analyses have been carried out to estimate the probability that, in the jurisdictions in which the Group is present, the requirements for the application of the simplified transitional regime known as “Safe Harbour” (governed in our legal system by the Ministerial Decree of 20 May 2024) will be met, which - if complied with - would make it possible not to apply the more complex regulatory system envisaged under the regime. In addition, analyses were carried out in order to estimate whether, in some of those jurisdictions, a GMT was due in relation to the results achieved in the tax period ended 31 December 2024.

These checks showed that in 2024 the requirements for the application of the simplified transitional regime are met in all the jurisdictions in which the Group operates and that, therefore, no Global Minimum Tax would be due in the same jurisdictions.

Consolidated Sustainability Statement

General information

ESRS 2 General disclosures

BP-1: General basis for preparation of sustainability statements

Reply Group’s 2024 consolidated sustainability statement has been prepared on a consolidated basis, in accordance with the requirements of the Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS). The scope of consolidation is aligned with that of Reply Group’s consolidated financial statements. The consolidated sustainability statement is based on the results of the Group’s double materiality assessment, considering relevant impacts, risks and opportunities. The assessment encompasses all stages of the Reply Group’s value chain, both upstream and downstream. Specifically, Reply’s value chain includes not only the activities and services directly provided by the Group, but also the upstream stages related to sourcing, and the downstream stages concerning the use of the Group’s services and solutions by clients and end users. A detailed description of the Group’s value chain and the outcomes of the double materiality assessment can be found in the following sections [SBM-1] Strategy, business model and value chain and [sbm-3] material impacts, risks and opportunities and their interaction with strategy and business model. For the purpose of sustainability indicators, the reporting aggregates operating locations by Region, based on the countries where the Group operates, as follows:

Region 1: Italy, Brazil, India, Romania, Poland1, USA, China (Nanjing);

Region 2: Germany, Poland, China (Beijing), Croatia, Austria;

Region 3: United Kingdom, Belgium, Netherlands, France, Luxembourg, Morocco.

In the 2024 reporting year, Reply did not make use of the option to omit specific information related to intellectual property, know-how or innovation outcomes, nor did it apply the exemption for disclosing information on upcoming developments or matters under negotiation. Unless otherwise stated, no metric included in this document has been verified by an external party other than the statutory auditor.

BP-2: Disclosures in relation to specific circumstances

In preparing the consolidated sustainability statement and in analysing information related to material sustainability impacts, risks and opportunities, Reply has adopted time horizons in line with the provisions of ESRS 1:

the short-term horizon is defined as a period of one year from the current reporting date;

the medium-term horizon covers a period from one to five years from the current reporting period;

the long-term horizon starts five years after the current reporting period.

The use of estimates, the level of accuracy achieved, and, where applicable, any actions planned to improve accuracy in the future are detailed within the report. For each quantitative amount, whether metric or monetary, the report provides information on the sources of measurement uncertainty, as well as the assumptions, estimates, approximations and judgements applied. For the purpose of reporting forward-looking information in accordance with the ESRS, the Directors are required to prepare such information based on assumptions—outlined in the consolidated sustainability statement—regarding events that may occur in the future and possible future actions by the Group. Due to the uncertainty inherent in the occurrence of any future event, both in terms of whether it will actually happen and the extent and timing of its manifestation, actual results may differ significantly from the forward-looking information. It is not possible to make a comparison in the presentation of sustainability information with the previous reporting period, as up to the 2023 reporting year, Reply was subject to the publication of the Reply Group’s Non-Financial Statement in accordance with the requirements of the GRI Standard of the Global Reporting Initiative. For the 2024 reporting year, no specific events or circumstances have been identified that significantly affected the Group’s sustainability performance. Lastly, no material reporting errors have been identified in previous reporting periods. This consolidated sustainability statement reporting includes information related to environmentally sustainable investments pursuant to Regulation (EU) 2020/852. In addition, the Group has chosen to include certain disclosure requirements by reference, which are explicitly indicated in the relevant chapters of this document.

Governance

This chapter provides an overview of the processes, controls and governance procedures established to monitor, manage and oversee the material impacts, risks and opportunities relevant to the Group.

[GOV-1] The role of the administrative, management and supervisory bodies

The administrative, management and supervisory bodies follow a clear hierarchical structure, led by the Board of Directors. This structure includes operational oversight bodies such as the Board of Statutory Auditors and several operational committees, including the Sustainability (ESG) Committee and the Control and Risks Committee.

The Board of Directors is the collective management body, vested with all powers related to both ordinary and extraordinary administration. It performs a guiding and supervisory role over the Group’s overall activities, aiming to achieve sustainable success and create medium- to long-term value for shareholders. The Board of Directors assesses management performance by comparing actual results with planned targets, and evaluates risks in line with strategic objectives, taking into account factors that may affect the Company’s sustainable success.

The Board also reviews and evaluates, on a regular basis and in conjunction with the approval of the annual and semi-annual financial reports, the adequacy of the Group’s organizational, administrative and accounting structure, with specific reference to the internal control and risk management system. This evaluation is also based on the preliminary work conducted by the Control and Risks Committee, which relies in turn on audits carried out by the Internal Audit function.

he Board of Directors of Reply S.p.A. consists of a variable number of members, ranging from 3 to a maximum of 11, as determined by the Shareholders’ Meeting. The number, expertise, authority, and time availability of the non-executive directors ensure that their judgement carries significant weight in board decision-making and that effective oversight of management is maintained.

Currently, the Company’s Board of Directors is composed of 10 members, of which: 5 are executive directors (2 women and 3 men), 1 is a non-executive director (male), and 4 are non-executive and independent directors (2 women and 2 men). For further details, please refer to the chapter [GOV-1] The role of the administrative, management and supervisory bodies.

There are no employee representatives or trade union delegates present within the Board of Directors or, more generally, within the organizational structure of Reply.

The current gender composition of the Board of Directors is 60% male and 40% female. With regard to diversity policies in the composition of the Board of Directors and the Board of Statutory Auditors, the Board has not deemed it necessary to formalize a dedicated diversity policy, as such principles are already applied within the company’s organizational framework. Moreover, national regulations provide adequate provisions to ensure gender balance, which the Company has complied with during the most recent appointments of the administrative and supervisory bodies.

The Company applies diversity criteria, including gender diversity, in the composition of both the Board of Directors and the Board of Statutory Auditors, in line with the primary objective of ensuring the appropriate competence and professionalism of their members. The composition of the Board of Directors and the control body is also adequately diversified in terms of age, educational background, and professional experience of the members in office.

The Board of Directors of Reply S.p.A. includes 4 Independent Directors out of a total of 10, representing 40% of the entire board, in accordance with the independence criteria established by applicable regulations. The appointment of directors is governed by the Company’s Articles of Association, specifically Article 16 “Appointment of Directors,” which takes into account gender balance requirements under national legislation.

For further information on the experience of the Board of Directors, please refer to the section [GOV-1] The role of the administrative, management and supervisory bodies.

Among the supervisory and control bodies, the Board of Statutory Auditors monitors compliance with the law and the Articles of Association, oversees corporate management, the adequacy of the organizational structure, and the implementation of the Corporate Governance Code. It also performs internal control and audit functions, monitoring financial reporting, the effectiveness of the internal control and risk management systems, the statutory audit of the accounts, and the independence of the external auditor. The statutory audit is not carried out by the Board itself but is entrusted to an audit firm appointed by the Shareholders’ Meeting.

As part of the oversight activities carried out during the year, the Board of Statutory Auditors coordinates with the Internal Audit function, the Control and Risks Committee, and the Supervisory Body through periodic information exchanges during the quarterly meetings of the Board, as well as through the participation of its Chairperson, and occasionally the Standing Auditors, in meetings of the Control and Risks Committee.

The Board of Statutory Auditors is composed of three Standing Auditors and two Alternate Auditors, specifically: Dr. Ciro Di Carluccio (Chair), Prof. Donatella Busso (Standing Auditor), Prof. Piergiorgio Re (Standing Auditor), Dr. Gabriella Chersicla (Alternate Auditor), and Dr. Stefano Barletta (Alternate Auditor).

In 2021, the Board of Directors established the Sustainability (ESG) Committee, supported operationally by the ESG team. The Committee is composed of CEO Eng. Tatiana Rizzante and Independent Directors Prof. Domenico Giovanni Siniscalco and Eng. Secondina Ravera. They are responsible for defining the overall strategic approach to sustainability, with a particular focus on the material impacts, risks, and opportunities relevant to the Group. The Committee defines objectives and monitoring methods, aiming to clearly communicate Reply’s commitment to sustainability issues to all stakeholders.

The CEO, Eng. Tatiana Rizzante, periodically reports to the full Board of Directors on the topics addressed by the Committee and the related proposals.

The Board of Directors has established the Control and Risks Committee, currently composed of Non-Executive and Independent Director Prof. Federico Ferro-Luzzi, Non-Executive Director Daniele Angelucci, and chaired by Lawyer Patrizia Polliotto (Lead Independent Director). The members possess adequate knowledge and experience in risk management, based on their professional backgrounds and expertise in the industry in which the Company operates.

The Control and Risks Committee meetings are attended, upon invitation by the Committee Chair, by the CFO—responsible for the internal control and risk management system—the Head of the Internal Audit function, the Chair of the Board of Statutory Auditors, and, on occasion, the Standing Auditors. At the end of each meeting, a specific report is drawn up, summarising the Committee’s proposals.

In the meeting held on 23 April 2024, the Board of Directors appointed Eng. Marco Cusinato as the Director in charge of the internal control and risk management system, entrusting him with the responsibility of ensuring its effectiveness and compliance with the provisions of the Corporate Governance Code. He is also responsible for ensuring that the Head of Internal Audit is provided with the necessary conditions to carry out their duties in accordance with regulatory requirements.

In the meeting held on 14 November 2024, the Board of Directors confirmed Mr. Edoardo Dezani as Head of the Internal Audit function, based on the proposal of the Director in charge of the internal control system, following the favourable opinion of the Control and Risks Committee and after consulting the Board of Statutory Auditors. He is responsible for verifying the functioning and adequacy of the internal control and risk management system.

The Head of Internal Audit reports hierarchically to the Lead Independent Director and operates based on the mandate and audit plan approved by the Board of Directors. He prepares periodic reports assessing the adequacy of the internal control and risk management system and the reliability of the information systems, including accounting systems, and reports on his work to the members of the Board of Directors, Senior Management, the Control and Risks Committee, and the Board of Statutory Auditors. The methodological approach adopted for the assessment of the internal control and risk management system, including sustainability-related risks, is based on the principles of the CoSO Framework, one of the main internationally recognized standards. For further details, please refer to paragraph [GOV-5] Risk management and internal controls over consolidated sustainability statement.

The effectiveness of the Board of Directors and its Committees—as well as their size and composition—is evaluated periodically in accordance with the Corporate Governance Code. The most recent evaluation was conducted on 13 March 2024, during which the Board concluded that the current structure of the Board and its Committees complies with the provisions of the Code.

[[GOV-2] Information provided to and sustainability matters addressed by the undertaking’s administrative, management and supervisory bodies

The Sustainability (ESG) Committee is responsible for monitoring the implementation and effectiveness of the Group’s sustainability policies, actions, metrics, and targets. The Committee meets at least twice a year to discuss and make decisions on sustainability matters and performs preparatory, advisory, and support functions for the Board of Directors in relation to sustainable development. The Committee also supports the Board of Directors in the preparation of the consolidated sustainability statement. In this context, an operational ESG team is in place. This team, working in close coordination with the Sustainability Committee, manages and oversees sustainability matters in collaboration with all key internal functions. In particular, it is responsible for preparing and drafting the Group’s consolidated sustainability statement on a regular basis. The ESG team reports directly to the CEO, confirming that sustainability is a core component of Reply’s strategy. The CEO informs the Board of Directors, from time to time, of the matters discussed and approved by the Sustainability Committee. The ESG-related topics and sub-topics identified through the double materiality analysis, as defined by the Sustainability Committee, were shared with and submitted for validation by the Board of Directors. The Sustainability Committee and the ESG Team therefore play a crucial role in overseeing the company’s strategy, in decisions related to significant operations, and in the risk management process. The approved relevant sustainability topics and sub-topics, along with the associated impacts, risks, and opportunities, are presented in paragraph [SBM-3] Material impacts, risks and opportunities and their interaction with strategy and business model.

[GOV-3] Integration of sustainability-related performance in incentive schemes

The Board of Directors, based on the proposal of the Remuneration Committee, adopts resolutions regarding the fixed remuneration of Executive Directors and defines the procedures for determining the variable component of their remuneration. The variable component is structured through the allocation of a profit-sharing scheme pursuant to Article 22 of the Company’s Articles of Association, with annual resolutions for the short-term component and resolutions at the beginning of the reference period for the medium- to long-term component.

The Shareholders’ Meeting approves, through a binding vote, the first section of the Remuneration Report, which contains the Remuneration Policy, with the frequency required by the duration of the policy as defined, and in any case at least every three years or whenever the policy is amended.

The current incentive plan was approved by the Shareholders’ Meeting on 23 April 2024. The incentive plan currently in force was approved by the Shareholders’ Meeting on April 23, 2024, and covers the period 2023-2026

The Remuneration Committee assesses performance as follows:

-

annually, with respect to the short-term variable component;

-

at the end of the reference period, for the medium- to long-term variable component.

Based on information and analyses provided by internal departments, the Committee formulates and shares with the Board of Directors the proposal for profit-sharing allocations to be submitted to the Shareholders’ Meeting, along with the related distribution. The Shareholders’ Meeting is then called upon to approve the proposed allocation of the variable remuneration component. With specific regard to incentive systems linked to sustainability matters, for the medium- and long-term variable component (valid through 31 December 2026), performance targets are set over a four-year period and are tied to the following indicators: EBIT (Earnings Before Interest and Taxes), TSR (Total Shareholder Return), CFO (Operating Cash Flow), and ESG. For the ESG indicator, the only defined target is the achievement of Carbon Neutrality by 2025. Performance indicators are weighted based on their alignment with the corporate strategy and the level of operational responsibility of Executive Directors and Executives with strategic responsibilities, as follows: 58% EBIT, 26% TSR, 8% CFO, and 8% ESG target of Carbon Neutrality.

[GOV-4] Statement on due diligence

Currently, the Reply Group has not yet defined a formalised procedure for the sustainability due diligence process. However, key elements of due diligence are in place and are presented in the following table, with references to the specific chapters and sections where they are addressed in detail.

[GOV-5] Risk management and internal controls over consolidated sustainability statement

The Board of Directors has established the Control and Risks Committee within its structure, with preparatory, advisory, and consultative functions, for the operational management of the internal control and risk management system. This Committee evaluates the effectiveness of the internal control system on a semi-annual basis and ensures that the information disclosed in this annual report is accurate and transparent. However, ultimate responsibility for the system lies with the Board of Directors, which defines its strategic guidelines and work plan, based on the Committee’s assessment, and monitors its adequacy. The methodological approach adopted for evaluating the internal control and risk management system—including sustainability-related risks—is based on the principles of the CoSO Framework, one of the internationally recognised standards. Using this model, the Group has mapped and carried out a qualitative assessment of the most significant risks (including those relevant to sustainability), both in terms of potential risk and associated first- and second-level controls, resulting in a measurement of residual risk. The Internal Audit function is responsible for monitoring the sustainability reporting process through control testing activities and identifying any weaknesses in the internal control system. Internal Audit reports the outcomes of these control activities semi-annually to the Board of Directors and the Control and Risks Committee. Based on the findings reported, action plans are subsequently defined and integrated into operational processes through a systematic and structured approach. The ESG team is responsible for drafting detailed procedures that define roles and responsibilities, ensuring full traceability of the entire reporting process. Furthermore, the ESG team ensures continuous training for staff involved in sustainability reporting, making sure they are always up to date on applicable regulations. Data collection is managed through an annual work plan, with periodic checks in place to ensure the accuracy and completeness of the information.

Strategy

The following sections analyse the elements of Reply’s strategy related to sustainability, its business model and value chain, highlighting how the Group integrates stakeholder interests and how the impacts, risks and opportunities identified through the double materiality assessment influence its overall strategy.

[SBM-1] Strategy, business model and value chain

The Reply Group offers a wide range of services, as detailed in the “Reply” section of the Financial Report. These include strategic consulting, communication, design, processes and technology, as well as system integration services that combine business consulting with innovative, high value-added technological solutions. In addition, Reply provides cutting-edge digital services by leveraging new communication channels and emerging digital trends. The main markets in which Reply operates are also described in the “Reply” section of the Financial Report.

The Group’s services extend across several geographic areas, divided into regions, as described in paragraph BP-1: General basis for preparation of sustainability statements. The number of employees active in each region is presented in the following paragraph ESRS S1 Own workforce.

In 2024, there were no significant changes in the services offered or in the markets where the Group operates. It should be noted that Reply does not provide prohibited services in restricted markets and is not active in the fossil fuel sector, chemical manufacturing, controversial weapons, or the cultivation and production of tobacco.

Through its first double materiality assessment, Reply identified the material impacts, risks and opportunities relevant to the Group, which guide the strategy and the business model with the goal of mitigating negative impacts and financial risks, while capturing opportunities and maximising positive impacts on key material topics. In general, the strategy is built around key pillars aimed at ensuring well-being and fairness for the workforce throughout the value chain, promoting energy efficiency and reducing greenhouse gas emissions through the implementation of low-consumption technologies and responsible energy management practices.

Lastly, the Group aims to expand its offering of sustainability-oriented solutions for its clients by developing consulting services that support companies in their transition toward more sustainable operating models. These strategic elements not only reinforce Reply’s commitment to sustainability but also help generate positive impacts on communities and the environment, creating value and building stakeholder trust.

For further details, please refer to paragraph [SBM-2] Interests and views of stakeholders.

Currently, Reply has not set specific sustainability-related targets in terms of significant product and service groups, customer categories, geographic areas, or stakeholder relationships. However, the Group has committed to achieving Carbon Neutrality by 2025 and Net Zero by 2030, as part of its transition towards a more sustainable and environmentally responsible business model. For further details, please refer to paragraph [E1-4] Targets related to climate change mitigation and adaptation.

Reply has not made use of the exemption from disclosure provided under Article 18(1)(a) of Directive 2013/34/EU.

For a description of Reply’s business model, main activities, and principal customer segments, please refer to the paragraph “Reply” in this “Annual Financial Report.”

For information on the cost and revenue structure, in accordance with the disclosure requirements under IFRS 8, please refer to NOTE 36 - Segment Reporting in the Financial Report.

he main resources used by the Group to carry out its business operations are:

Human capital, which is crucial to delivering and ensuring the quality of the services offered by the Group. In this regard, Reply invests in the training and professional development of its employees, ensuring they have the necessary skills to perform their duties, and in welfare systems to attract and retain top talent. For more information, please refer to the chapter “Social Information – Own Workforce.”

IT and technological systems: Reply invests in advanced technologies and adopts an innovative approach to develop and implement technological solutions that support its business activities.

Reply’s value chain

Reply operates through a network structure composed of specialised companies focused on processes, applications, and technologies, which act as centres of excellence in their respective areas:

Processes - For Reply, understanding and applying technology means introducing an enabling factor for business processes, thanks to in-depth knowledge of the market and specific industrial contexts.

Applications - Reply designs and develops application solutions tailored to the core business needs of clients across various industry sectors.

Technologies - Reply optimises the use of innovative technologies, delivering solutions that ensure maximum efficiency and operational flexibility for its clients.

Reply’s services include:

Consulting - strategic, communication, design, process and technology consulting;

System Integration - to fully leverage technological potential by combining business consulting with innovative, high value-added technology solutions;

Digital Services - innovative services based on new communication channels and emerging digital trends.

Reply’s value chain includes not only the above-mentioned services delivered directly by the Group, but also upstream phases relating to direct and indirect procurement, as well as downstream phases concerning the use of the Group’s solutions by its clients, as illustrated in the table below.

[SBM-2] Interests and views of stakeholders

Stakeholder engagement activities aim to integrate stakeholder expectations and views into the Group’s strategy and business model. These activities foster continuous and transparent dialogue throughout the entire value chain, with the goal of building long-lasting trust-based relationships. Below are the main categories of stakeholders identified by Reply.

Reply Group adopts a continuous dialogue and engagement approach with its stakeholders through targeted initiatives, structured moments of interaction, and the regular sharing of information. The table below outlines the main stakeholder categories identified by the Group, along with the commonly used engagement channels. Stakeholder engagement activities have provided valuable input for conducting the double materiality assessment and informing its outcomes. Specific internal stakeholder categories—including key corporate functions, top management, and members of the Board of Directors—were directly involved in evaluating the relevance of sustainability topics through dedicated meetings or interviews. This demonstrates that the interests of stakeholders are carefully considered in the development of Reply’s sustainability strategy. Moreover, the administrative, management and supervisory bodies of Reply receive regular updates on stakeholder views and interests, including the outcomes of the double materiality assessment. No additional stakeholder engagement measures are currently planned beyond those conducted on an annual basis.

[SBM-3] Material impacts, risks and opportunities and their interaction with strategy and business model